Thus, it is possible to run simulations at different price points so that it will be easier to calculate changes in your own or in your competitor’s prices.ĥ. Upon the calculation of the interaction between price and the other attributes, it is possible to measure the sensitivity of prices that may vary with respect to the brand name as well as the other attributes. Utilities for price levels will offer one measure of sensitivity of the market or the market segment. In fact, even if can be difficult to prove, the more it closely resembles real behavior, the more the results will become valid and reliable. With conjoint analysis, they can mimic the decision process made by customers. This is where they are allowed to look at available alternatives and pick one being preferred more. Close Resemblance of Customer DecisionsĬustomers are able to provide decisions in the market place. It will also enable you to redesign existing products or make new products using the benefits you have in mind.ģ. Understanding the value that people put in your services or products will allow you to design marketing programs that should communicate the benefits.

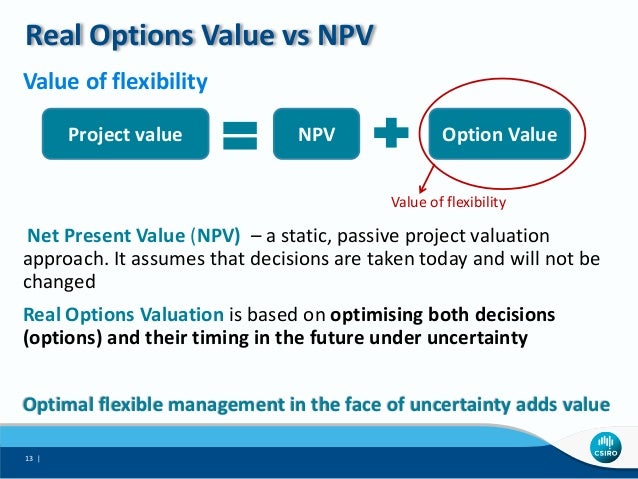

It is the measurement of the actual and perceived benefits wherein it lies at the center of most of the approaches of market segmentation. One of the best techniques to measure the benefits as seen by buyers is the use of conjoint analyses. In conjoint analysis, however, it is imperative to make estimates on how the market makes such tradeoffs between specific features, prices, and brands. More so, it is possible to desire a set of features that is enough to offset the investment regarding brand equity. It may not be enough to have only a dominant brand name if majority of the market is price sensitive. Unlike other methods of measurement for brand equity, conjoint analysis should be able to obtain information regarding brand strength or popularity compared to specific product prices and features. The method of conjoint analysis is perfect for measuring value of brand names related to competing brands. This will enable you to see how the market has reacted in response to price cuts, new products, and other changes. Thus, you and your managers will be able to make their own scenarios based on the market. For instance, you can receive your own program for simulation. With this method, it can also be useful to run market simulations in order to predict the reaction of the market with regards to different scenarios. This can be viewed on a listing showing attribute levels and corresponding utilities that should be calculated for certain attribute levels. However, conjoint analysis can likewise be applicable for carefully designed data or configurator from the test market experiment.īasically, you can gain thorough understanding about the market and the value or your services or products as how respondents see it.

The procedure of conjoint analysis involves the gathering of data through marketing research survey. Such implicit valuations can be utilized in the creation of market models that should be able to estimate revenue, market share, and profitability. It will analyze how the respondents make preferences between the products in order to determine implicit valuation of individual elements. This method is used using a controlled set of products or services that will be presented to respondents. This is intended to determine which combination of limited attributes is most prominent based on the choice of respondents. The term conjoint analysis has been used in market research as a statistical technique to determine how people would value various attributes such as benefits, feature and function, making up a product or service.

0 kommentar(er)

0 kommentar(er)